CWWdelegates.

Under state law, the CWW coordinates

one of four 911 Service Districts within

Wayne County. As a large number of resi-

dents use text messaging for various com-

munications, officials of the 18 CWW com-

munities began working in 2015 to test and

implement new technology to allow text

messages to local 911 emergency centers

when seeking help or to report emergen-

cies.

“The Canton Public Safety Department

is eager to be a part of this newE/911 initia-

tive, providing an alternate method of con-

tact for citizens to request police, fire and

emergency medical services. Our staff has

been trained and is ready to start accepting

requests for service via text message,” said

ToddL. Mutchler, director of CantonPublic

Safety.

Text-to-911 is an important new service

that offers citizens who are deaf, hard of

hearing, or have a speech disability, a new

way to contact emergency services. Other

examples of a citizen needing text-to-911

service could include domestic violence,

kidnapping and other situations where vic-

tims need a way to call for helpwithout tip-

ping off a criminal during the commission

of a crime, officials said.

“Our 18 communities did something you

don't hear much about these days-we

worked together to benefit everyone. We

work tirelessly to grow Western Wayne

County and provide our citizens with the

best services possible. And as a region we

chose to combine our efforts to bring this

new access to 911 to our 700,000 residents,

100,000 businesses and all those who travel

through and work in our communities

every day. Public safety is the first priority

of local government and the CWW prides

itself on protecting our citizens,” Wild said

whenmaking the announcement.

Howdoes it work?

Anyone who is within the borders of the

18 CWW communities can use the service,

as long as they have a texting planwith one

of the four major carriers: AT&T, Sprint, T-

Mobile or Verizon. The service is activated

by sending a text on a mobile phone to 911.

That text message will be routed to the

nearest CWW 911 dispatch center for

action.

At the current time, the rest of Wayne

County does not have text-to-911 service,

although some neighboring counties such

as Oakland and Macomb have fully imple-

mented text-to-911. If the texter is in an

area that does not support text-to-911, they

will receive a “bounce-back” message

informing them911 is not available via text.

Officials emphasized that text-to-911 is a

complement to calling 911, not a replace-

ment, because voice calls to 911 are still the

most efficient way to communicate with

public safety officials in an emergency situ-

ation.

Communities affected by the new serv-

ice include the cities of Belleville,

Dearborn, Dearborn Heights, Garden City,

Inkster, Livonia, Northville, Plymouth,

Romulus, Wayne and Westland, and the

townships of Canton, Huron, Northville,

Plymouth, Redford, Sumpter and Van

Buren.

A

SSOCIATED

N

EWSPAPERS OF

M

ICHIGAN

P

AGE

4

April 21, 2016

Olympians sought for parade

the acquisition and construction of water supply system capital improvements in the Township. The full faith and credit of the

Township have been pledged for the prompt payment of the principal of and interest on this bond. Taxes imposed by the Township

are subject to constitutional, statutory and charter tax limitations. This bond is transferable, as provided in the Resolution, only

upon the books of the Township kept for that purpose by the bond registrar and paying agent, upon the surrender of this bond

together with a written instrument of transfer satisfactory to the bond registrar and paying agent duly executed by the Registered

Owner or his attorney duly authorized in writing. Upon the exchange or transfer of this bond a new bond or bonds of any author-

ized denomination, in the same aggregate principal amount and of the same interest rate and maturity, shall be authenticated and

delivered to the transferee in exchange therefor as provided in the Resolution, and upon payment of the charges, if any, therein

provided. Bonds so authenticated and delivered shall be in the denomination of $_______ or any integral multiple of $_____not

exceeding the aggregate principal amount for each maturity. The bond registrar and paying agent shall not be required to trans-

fer or exchange bonds or portions of bonds that have been selected for redemption. MANDATORY REDEMPTION Bonds

maturing in the year ____ are subject to mandatory prior redemption at par and accrued interest as follows: Redemption Date

Principal Amount of Bonds to be Redeemed

Bonds or portions of bonds to be redeemed by mandatory redemption shall be

selected by lot. (REPEAT IF MORE THAN ONE TERM BOND) OPTIONAL PRIOR REDEMPTION Bonds maturing prior to

________, 201_, are not subject to redemption prior to maturity. Bonds maturing on and after to ________, 201_, are subject to

redemption prior to maturity at the option of the Township, in such order as shall be determined by the Township, on any date

on and after __________, 201_. Bonds of a denomination greater than $_______ may be partially redeemed in the amount of

$_______ or any integral multiple of $_____. If less than all of the bonds maturing in any year are to be redeemed, the bonds or

portions of bonds to be redeemed shall be selected by lot. The redemption price shall be the par value of the bond or portion of

the bond called to be redeemed plus interest to the date fixed for redemption. Not less than thirty but not more than sixty days’

notice of redemption shall be given to the Registered Owner of bonds called to be redeemed by mail to each Registered Owner

at the registered address. Bonds or portions of bonds called for redemption shall not bear interest on and after the date fixed for

redemption, provided funds are on hand with the bond registrar and paying agent to redeem the same. It is hereby certified, recit-

ed and declared that all acts, conditions and things required to exist, happen and be performed precedent to and in the issuance

of the bonds of this series, existed, have happened and have been performed in due time, form and manner as required by law,

and that the total indebtedness of the Township, including the series of bonds of which this bond is one, does not exceed any con-

stitutional, statutory or charter tax limitation. IN WITNESS WHEREOF, the Charter Township of Canton, State of Michigan, by

its Township Board, has caused this bond to be executed in its name by the manual or facsimile signatures of the Supervisor and

the Clerk and its corporate seal (or a facsimile thereof) to be impressed or imprinted thereon. This bond shall not be valid unless

the Certificate of Authentication has been manually executed by the bond registrar and paying agent or an authorized represen-

tative of the bond registrar and paying agent. CHARTER TOWNSHIP OF CANTON By: Its: Supervisor And: Its: Clerk CER-

TIFICATE OF AUTHENTICATION This bond is one of the bonds described in the within mentioned Resolution. Bond Registrar

and Paying Agent By: Authorized Representative AUTHENTICATION DATE: ASSIGNMENT For value received, the under-

signed hereby sells, assigns and transfers unto ______ (please print or type name, address and taxpayer identification number of

transferee) the within bond and all rights thereunder and hereby irrevocably constitutes and appoints ______ attorney to transfer

the within bond on the books kept for registration thereof, with full power of substitution in the premises. Dated: ___ ____

Signature Guaranteed: ______ Signature(s) must be guaranteed by an eligible guarantor institution participating in a Securities

Transfer Association recognized signature guarantee program. SECURITY. There shall be levied upon all taxable property in the

Township upon the tax roll for each year while any of the Bonds shall be outstanding an amount such that the estimated collec-

tions therefrom will be sufficient to pay promptly at maturity the principal and interest maturing on the Bonds prior to the time

of the following year’s tax collections. Taxes required to be levied to pay principal of and interest on the Bonds shall be subject

to constitutional, statutory and charter tax limitations. The proceeds of such taxes (both current and delinquent) shall be deposit-

ed as collected into a debt retirement fund that shall be established and maintained for the Bonds as either a separate or a com-

mon fund as permitted by law, and until the principal of and the interest on the Bonds are paid in full, such proceeds shall be used

only for payment of such principal and interest or for other authorized purposes of the fund. The amounts to pay principal of and

interest on the Bonds as described in this section can be derived from Township water and sewer rates and charges. To the extent

that the Township has funds lawfully available from water and sewer rates and charges at the time of making its annual tax levy

for payment of principal or interest, the annual levy for such purpose shall be adjusted to reflect such available funds. ESTI-

MATES OF PERIOD OF USEFULNESS AND COST. The estimated period of usefulness of the Project for which the Bonds

are to be issued is hereby determined to be thirty (30) years and upwards, and the estimated cost of the Project in the amount of

not less than $8,500,000 as submitted to this Township Board is hereby approved and adopted. USE OF BOND PROCEEDS –

CONSTRUCTION FUND. From the proceeds of the sale of the Bonds there shall be set aside in the debt retirement fund any

accrued interest received from the purchaser at the time of delivery of the Bonds and such portion of any premium received from

the purchaser at such time as determined by the Director of Finance and Budget or the Supervisor. Thereafter, $8,500,000 of the

proceeds of the sale of the Bonds, or such lesser amount as determined by the Director of Finance and Budget or the Supervisor,

shall be set aside in a construction fund and used to pay the costs of issuing the Bonds allocated to the Project and to acquire and

construct the Project. The allocation of issuance and other costs and any premium and discount from the sale of the Bonds to the

Project and to the refunding of the Prior Bonds shall be determined by Director of Finance and Budget or the Supervisor. PAY-

MENT OF COSTS OF ISSUANCE - ESCROW FUND. The remainder of the proceeds of the Bonds shall be used to pay the

costs of issuance of the Bonds allocated to the refunding of the Prior Bonds and to refund the Prior Bonds maturing in the years

determined by order of the Director of Finance and Budget or the Supervisor (the “Prior Bonds To Be Refunded”). After the costs

of issuance have been paid or provided for the remaining proceeds shall be used, together with such amounts transferred from

the principal and interest fund for the Prior Bonds and any other available funds of the Township in such amounts as determined

by the Director of Finance and Budget or the Supervisor, to establish an escrow fund (the “Escrow Fund”) consisting of cash and

investments in direct obligations of, or obligations the principal of and interest on which are unconditionally guaranteed by, the

United States of America or other obligations the principal of and interest on which are fully secured by the foregoing and used

to pay the principal of, interest on and redemption premiums, if any, on the Prior Bonds To Be Refunded. The Escrow Fund shall

be held by an escrow agent (the “Escrow Agent”) pursuant to an Escrow Agreement (the “Escrow Agreement”), which irrevoca-

bly shall direct the Escrow Agent to take all necessary steps to pay the principal of and interest on the Prior Bonds To Be

Refunded when due and to call such Prior Bonds To Be Refunded at redemption at such time as shall be determined in the Escrow

Agreement. The Director of Finance and Budget or the Supervisor is authorized to select the Escrow Agent and enter into the

Escrow Agreement on behalf of the Township. The amounts held in the Escrow Fund shall be such that the cash and the invest-

ments and the income received on the investments will be sufficient without reinvestment to pay the principal of, interest on and

redemption premiums, if any, on the Prior Bonds when due at maturity or call for redemption as required by the Escrow

Agreement. DEFEASANCE. In the event cash or direct obligations of the United States or obligations the principal of and inter-

est on which are guaranteed by the United States, or a combination thereof, the principal of and interest on which, without rein-

vestment, come due at times and in amounts sufficient to pay, at maturity or irrevocable call for earlier optional redemption, the

principal of, redemption premium, if any, and interest on all or any portion of the Bonds, shall have been deposited in trust, this

resolution shall be defeased and the owners of the Bonds shall have no further rights under this resolution except to receive pay-

ment of the principal of, redemption premium, if any, and interest on the Bonds from the cash or securities deposited in trust and

the interest and gains thereon and to transfer and exchange Bonds as provided herein. APPROVAL OF DEPARTMENT OF

TREASURY. The issuance and sale of the Bonds shall be subject to the Township obtaining qualified status or prior approval

from the Department of Treasury of the State of Michigan pursuant to Act 34 and, if necessary, the Director of Finance and

Budget or the Supervisor is authorized and directed to make application to the Department of Treasury for approval to issue and

sell the Bonds as provided by the terms of this resolution and by Act 34. The Director of Finance and Budget or the Supervisor

is authorized to pay any filing fees required in connection with obtaining qualified status or prior approval from the Department

of Treasury. The Director of Finance and Budget or the Supervisor is further authorized to request such waivers of the require-

ments of the Department of Treasury or Act 34 as the Director of Finance and Budget or the Supervisor shall determine to be

necessary or desirable in connection with the sale of the Bonds. SALE, ISSUANCE, DELIVERY, TRANSFER AND

EXCHANGE OF BONDS. The Bonds shall be sold pursuant to a negotiated sale in accordance with Act 34. It is hereby deter-

mined that such negotiated sale is in the best interests of the Township and is calculated to provide maximum flexibility in the

pricing of the Bonds so as to achieve sufficient debt service savings with respect to the Prior Bonds and the lowest cost of bor-

rowing funds for the Project. The Director of Finance and Budget or the Supervisor is authorized to negotiate a bond purchase

agreement with Fifth Third Securities, Inc. and any co-managing or other underwriters to be selected by the Director of Finance

and Budget or the Supervisor at or prior to the time of the sale of the Bonds (collectively, the “Underwriter”). Such bond pur-

chase agreement shall set forth the principal amount, principal maturities and dates, interest rates and interest payment dates,

redemption provisions and purchase price to be paid by the Underwriter with respect to the Bonds, as well as such other terms

and provisions as the Director of Finance and Budget or the Supervisor determines to be necessary or appropriate in connection

with the sale of the Bonds. The Supervisor, the Clerk, the Treasurer, the Director of Finance and Budget and other appropriate

officials of the Township are authorized to do all things necessary to effectuate the sale, issuance, delivery, transfer and exchange

of the Bonds in accordance with the provisions of this resolution. In making the determination in the order authorizing the sale

of the Bonds and in the bond purchase agreement with respect to principal maturities and dates, interest rates, purchase price of

the Bonds and compensation to be paid to the Underwriter, the Director of Finance and Budget or the Supervisor shall be limit-

ed as follows: (a) The interest rate on any Bond shall not exceed 5% per annum. (b) The final maturity date of the Bonds shall

not be later than April 1, 2027. (c) The Bonds shall be sold at a price not less than 97.50% of the par value of the Bonds. (d) The

Underwriter’s discount with respect to the Bonds shall not exceed 0.5% of the principal amount of the Bonds. REPLACEMENT

OF BONDS. Upon receipt by the Supervisor of proof of ownership of an unmatured Bond, of satisfactory evidence that the Bond

has been lost, apparently destroyed or wrongfully taken and of security or indemnity that complies with applicable law and is

satisfactory to the Supervisor, the Supervisor may authorize the bond registrar and paying agent to deliver a new executed Bond

to replace the Bond lost, apparently destroyed or wrongfully taken in compliance with applicable law. In the event an outstand-

ing matured Bond is lost, apparently destroyed or wrongfully taken, the Supervisor may authorize the bond registrar and paying

agent to pay the Bond without presentation upon the receipt of the same documentation required for the delivery of a replace-

ment Bond. The bond registrar and paying agent, for each new Bond delivered or paid without presentation as provided above,

shall require the payment of expenses, including counsel fees, which may be incurred by the bond registrar and paying agent and

the Township in the premises. Any Bond delivered pursuant to the provisions of this Section in lieu of any Bond lost, apparent-

ly destroyed or wrongfully taken shall be of the same form and tenor and be secured in the same manner as the Bond in substi-

tution for which such Bond was delivered. TAX COVENANT. The Township covenants to comply with all applicable require-

ments of the Internal Revenue Code of 1986, as amended (the “Code”), necessary to assure that the interest on the Bonds will be

and will remain excludable from gross income for federal income tax purposes. The Supervisor, the Clerk, the Treasurer, the

Director of Finance and Budget and other appropriate officials of the Township are authorized to do all things necessary (includ-

ing the making of such covenants of the Township as shall be appropriate) to assure that the interest on the Bonds will be and

will remain excludable from gross income for federal income tax purposes. NOT QUALIFIED TAX-EXEMPT OBLIGATIONS.

The Bonds are not designated as “Qualified Tax-Exempt Obligations” as described in Section 265(b)(3)(B) of the Code.. OFFI-

CIAL STATEMENT. The Director of Finance and Budget or the Supervisor is authorized to cause the preparation of an official

statement for the Bonds for the purpose of enabling compliance with Rule 15c2-12 issued under the Securities Exchange Act of

1934, as amended (the “Rule”), and to do all other things necessary to enable compliance with the Rule. After the award of the

Bonds, the Township will provide copies of a “final official statement” (as defined in paragraph (e)(3) of the Rule) on a timely

basis and in reasonable quantity as requested by the Underwriter to enable the Underwriter to comply with paragraph (b)(4) of

the Rule and the rules of the Municipal Securities Rulemaking Board. CONTINUING DISCLOSURE. The Director of Finance

and Budget or the Supervisor is authorized to execute and deliver in the name and on behalf of the Township (i) a certificate of

the Township to comply with the requirements for a continuing disclosure undertaking of the Township pursuant to subsection

(b)(5) of the Rule and (ii) amendments to such certificate from time to time in accordance with the terms of such certificate (the

certificate and any amendments thereto are collectively referred to herein as the “Continuing Disclosure Certificate”). The

Township hereby covenants and agrees that it will comply with and carry out all of the provisions of the Continuing Disclosure

Certificate. The remedies for any failure of the Township to comply with and carry out the provisions of the Continuing

Disclosure Certificate shall be as set forth therein. BOND INSURANCE. The Director of Finance and Budget or the Supervisor

is authorized and directed to take any actions that may be necessary or appropriate to purchase a policy or policies of municipal

bond insurance with respect to the Bonds to the extent that the Director of Finance and Budget or the Supervisor determines in

the order approving the sale of the Bonds that the purchase of such municipal bond insurance is in the best interests of the

Township. If the Director of Finance and Budget or the Supervisor makes such a determination, the purchase of a policy or poli-

cies and the payment of premiums therefor and the execution by the Director of Finance and Budget or the Supervisor of any

necessary commitments or other documents with respect thereto are hereby authorized. APPOINTMENTS. Dickinson Wright

PLLC is hereby appointed to act as bond counsel and Bendzinski & Co., Municipal Finance Advisors is hereby appointed to act

as registered municipal advisor with respect to the Bonds. CONFLICTING RESOLUTIONS. All resolutions and parts of reso-

lutions insofar as they may be in conflict herewith are rescinded. RESOLUTION DECLARED ADOPTED. YEAS: NAYS:

ABSTENTIONS: STATE OF MICHIGAN ) )ss COUNTY OF WAYNE ) I, the undersigned, the duly qualified and acting Clerk

of the Charter Township of Canton, Michigan, do hereby certify that the foregoing is a true and complete copy of a resolution

adopted at a regular meeting of the Township Board of the Charter Township of Canton, Michigan, held on the 12 th day of April,

2016, the original of which resolution is on file in my office and is available to the public. Public notice of said meeting was

given in accordance with the provisions of the open meeting act. IN WITNESS WHEREOF, I have hereunto affixed my official

signature on this 13 day of April, 2016. Clerk, Charter Township of Canton

ADDITIONAL PUBLIC COMMENT:

None

OTHER:

None

ADJOURN:

Motion by Anthony, supported by Sneideman to adjourn at 8:33 p.m. Motion carried unanimous-

ly.

______ Terry G. Bennett, Clerk

Copies of the complete text of the Board Minutes are available at the Clerk’s office of the Charter Township of Canton, 1150 S.

Canton Center Rd, Canton, MI 48188, 734-394-5120, during regular business hours and can also be accessed through our web

site

after Board Approval.

EC042116-1313 5 x 21 + 2.5 x 17.646

Continued from page 3.

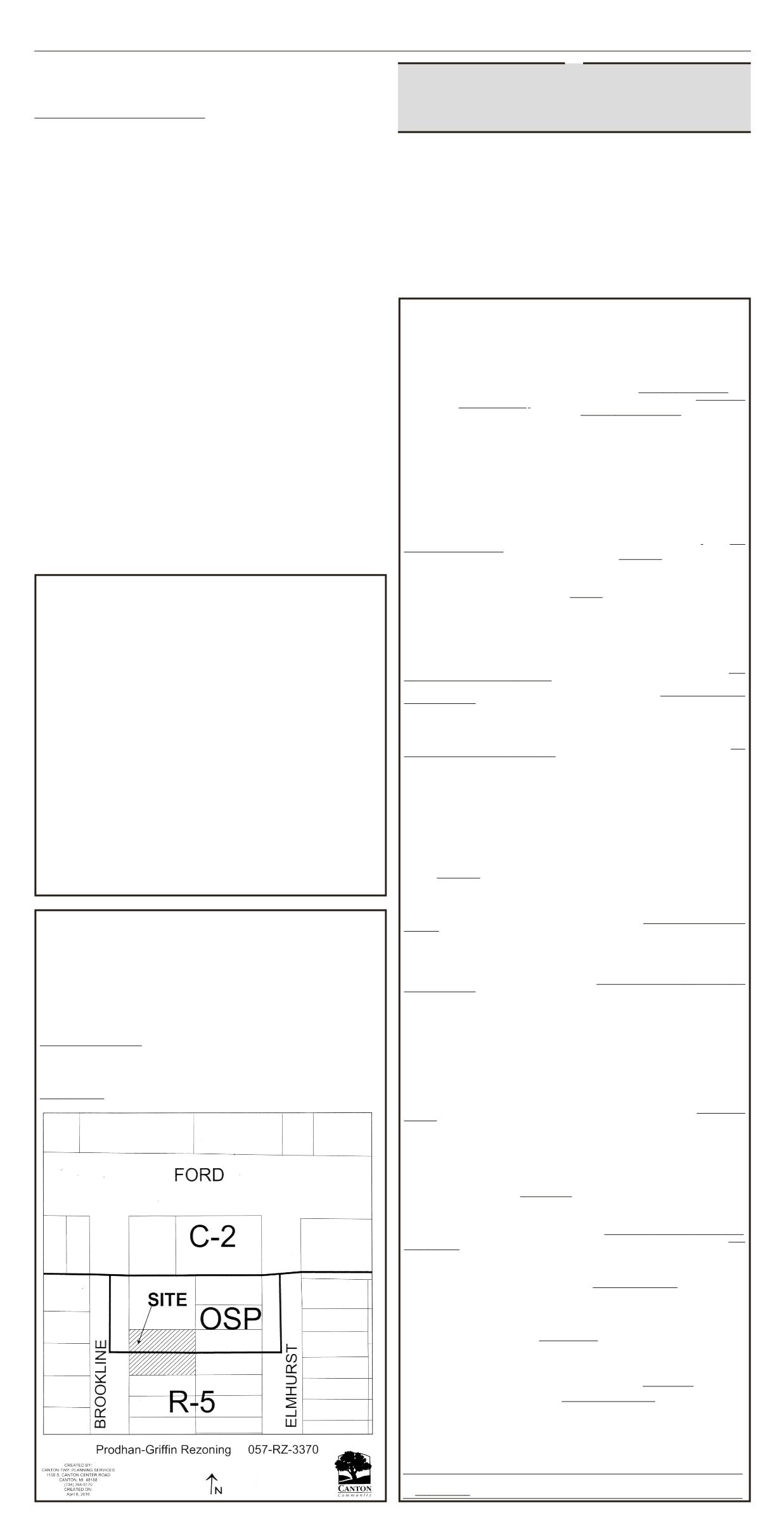

PLANNING COMMISSION

CHARTER TOWNSHIP OF CANTON

NOTICE OF PUBLIC HEARING

PROPOSED AMENDMENT TO THE ZONING ORDINANCE OF THE CHARTER TOWNSHIP OF CANTON, WAYNE

COUNTY, MICHIGAN.

NOTICE IS HEREBY GIVEN pursuant to Michigan Public Act 110 of 2006, of the State of Michigan, as amended, and pursuant

to the Zoning Ordinance of the Charter Township of Canton that the Planning Commission of the Charter Township of Canton

will hold a Public Hearing on Monday, May 9, 2016 in the

First Floor Meeting Room of the Canton Township Administration

Building, 1150 S. Canton Center Road at 7:00 p.m.

on the following proposed amendment to the Zoning Ordinance:

AN ORDINANCE AMENDING APPENDIX A - ZONING, OF THE CODE OF ORDINANCES OF THE CHARTER

TOWNSHIP OF CANTON, MICHIGAN, BY AMENDING ARTICLE 8.00 - AMENDING THE DISTRICT BOUND-

ARIES ON THE ZONING MAPAS FOLLOWS;

PRODHAN/GRIFFIN REZONING

- CONSIDER REQUEST TO REZONE PARCEL NOS. 057 01 0401 000 AND 057 01

0402 000 (2088 BROOKLINE) FROM R-5, SINGLE-FAMILY RESIDENTIAL TO OSP, OFF STREET PARKING. Property

is located south of Ford Road between Sheldon Road and Brookline Road.

Written comments addressed to the Planning Commission should be received at the Canton Township Administration Building,

1150 Canton Center S. prior to Thursday, May 5, 2016 in order to be included in the materials submitted for review.

SEE ATTACHED MAP

Greg Greene, Chairman

Publish: Newspaper--April 21, 2016

EC042116-1312 2.5 x 8.687

CHARTER TOWNSHIP OF CANTON

ACCESS TO PUBLIC MEETINGS

The Charter Township of Canton will provide necessary, reasonable auxiliary aids and services to individuals with disabilities at

the meeting/hearing upon notice to the Charter Township of Canton.

In accordance with the requirements of Title II of the Americans with Disabilities Act of 1990 (“ADA”), the Charter Township

of Canton will not discriminate against qualified individuals with disabilities on the basis of disability in its services, programs,

or activities.

Employment:

The Charter Township of Canton does not discriminate on the basis of disability in its hiring or employment prac-

tices and complies with all regulations promulgated by the U.S. Equal Employment Opportunity Commission under Title II of

the ADA.

Effective Communication:

The Charter Township of Canton will generally, upon request, provide appropriate aids and services

leading to effective communication for qualified persons with disabilities so they can participate equally in the Charter Township

of Canton's programs, services, and activities, including qualified sign language interpreters, documents in Braille, and other

ways of making information and communications accessible to people who have speech, hearing, or vision impairments.

Modifications to Policies and Procedures:

The Charter Township of Canton will make all reasonable modifications to policies

and programs to ensure that people with disabilities have an equal opportunity to enjoy all of its programs, services, and activi-

ties. For example, individuals with service animals are welcomed in the Charter Township of Canton's offices, even where pets

are generally prohibited.

Anyone who requires an auxiliary aid or service for effective communication, or a modification of policies or procedures to par-

ticipate in a program, service, or activity of the Charter Township of Canton should contact the office of Barb Brouillette, Human

Resources Coordinator, Charter Township of Canton, 1150 S. Canton Center Road, Canton, MI 48188, (734) 394-5260 as soon

as possible but no later than 48 hours before the scheduled event.

The ADA does not require the Charter Township of Canton to take any action that would fundamentally alter the nature of its

programs or services, or impose an undue financial or administrative burden.

Complaints that a program, service, or activity of the Charter Township of Canton is not accessible to persons with disabilities

should be directed to Barb Brouillette, Human Resources Coordinator, Charter Township of Canton, 1150 S. Canton Center Road,

Canton, MI 48188, (734) 394-5260.

The Charter Township of Canton will not place a surcharge on a particular individual with a disability or any group of individu-

als with disabilities to cover the cost of providing auxiliary aids/services or reasonable modifications of policy, such as retriev-

ing items from locations that are open to the public but are not accessible to persons who use wheelchairs.

Publish: 4/21/2016

EC042116-1311 2.5 x 4.72

TheNorthvilleCommunityFoundation

is searching for Olympic athletes to help

celebrate theFourthof July this year.

The foundation organizes and coordi-

nates

the

annual

Northville

Independence Day Parade, one of the

largest in the state, and this year has cho-

sen Cheers for Team USA! Celebrating

the 2016 Summer Olympics as the parade

theme. To promote the celebration of

Olympic athletes, the parade committee is

hoping to include past Olympic competi-

tors in the entries.

Former or current Olympic,

Paralympics or Special Olympic athletes

who have competed in any sport during

the summer or winter games in any year

are invited to participate in the parade,

said Jessica Striegle, the director of the

NorthvilleCommunityFoundation.

Athletes or others interested in joining

the event should call Striegle at the foun-

dation office at (248) 374-0200 or email

911

FROM PAGE 1

Our 18 communities did something

you don't hear much about these

days-we worked together to benefit everyone.

”