A

SSOCIATED

N

EWSPAPERS OF

M

ICHIGAN

P

AGE

2

June 7, 2018

MINUTES OF REGULAR ROMULUS CITY COUNCIL MEETING

May 14, 2018

Romulus City Hall Council Chambers, 11111 Wayne Rd. Romulus, MI 48174

The meeting was called to order at 7:30 p.m. by Mayor Pro-Tem John Barden.

Pledge of Allegiance

Roll Call:

John Barden, Celeste Roscoe, Tina Talley, William Wadsworth, Eva Webb, Virginia Williams.

Excused:

Kathy Abdo.

Administrative Officials in Attendance:

LeRoy D. Burcroff, Mayor

Ellen L. Craig-Bragg, Clerk

Stacy Paige, Treasurer

1.

Moved by

Talley,

seconded by

Roscoe

to accept the agenda as presented.

Motion Carried Unanimously

.

18-167 2A.

Moved by

Wadsworth,

seconded by

Roscoe

to approve the minutes of the regular meeting of the

Romulus City Council held on May 7, 2018.

Motion Carried Unanimously

.

18-168 2B.

Moved by

Roscoe,

seconded by

Talley

to approve the minutes of the special meeting of the Romulus

City Council held on May7, 2018 – closed session, attorney opinion; and public hearing 2018/2019 City Budget.

Motion Carried Unanimously

.

3. Petitioner: None.

4. Chairperson’s Report:

Mayor Pro-Tem John Barden read and presented a resolution to Romulus High School student, Gabrielle Futch, to

recognize her outstanding achievements in academics and athletics. Mayor Burcroff presented a proclamation to

Ms. Futch. Councilman Wadsworth thanked everyone who contributed to the recent Bowl-a-Thon Animal Shelter

fundraiser. A total of $3,018.00 was raised at the event – bringing the overall total donations to $290,000.

4.

Moved by

Roscoe,

seconded by

Talley

to accept the Chairperson’s Report.

Motion Carried Unanimously

.

5. Mayor’s Report:

Dennis Davidson read a list of upcoming City events.

18-169 5.

Moved by

Roscoe,

seconded by

Talley

to schedule a study session on Monday, June 4, 2018 at 5:30 p.m.

to discuss a Public Safety Millage.

Motion Carried Unanimously

.

18-170 5A

. Moved by

Wadsworth,

seconded by

Roscoe

to concur with the administration and adopt a resolution

exempting City employees from either of the cost-sharing options (of Public Act 152) effective July 1, 2018

through June 30, 2019.

Motion Carried Unanimously

.

18-171 5B

. Moved by

Roscoe,

seconded by

Wadsworth

to concur with the administration and adopt the General

and Special Appropriations Act and Tax Levy Authorization for the City of Romulus and 34 th District Court Fiscal

Year 2018-2019, as submitted by Mayor Burcroff. Discussion: Councilwoman Williams asked for an explanation

of the General Appropriations Act – and Mayor Burcroff read Section 37 of the Act which lists the amounts of the

millages. Councilwoman Webb thanked Finance Director, Suzanne Moreno, for sending updates to City Council

regarding the City Budget.

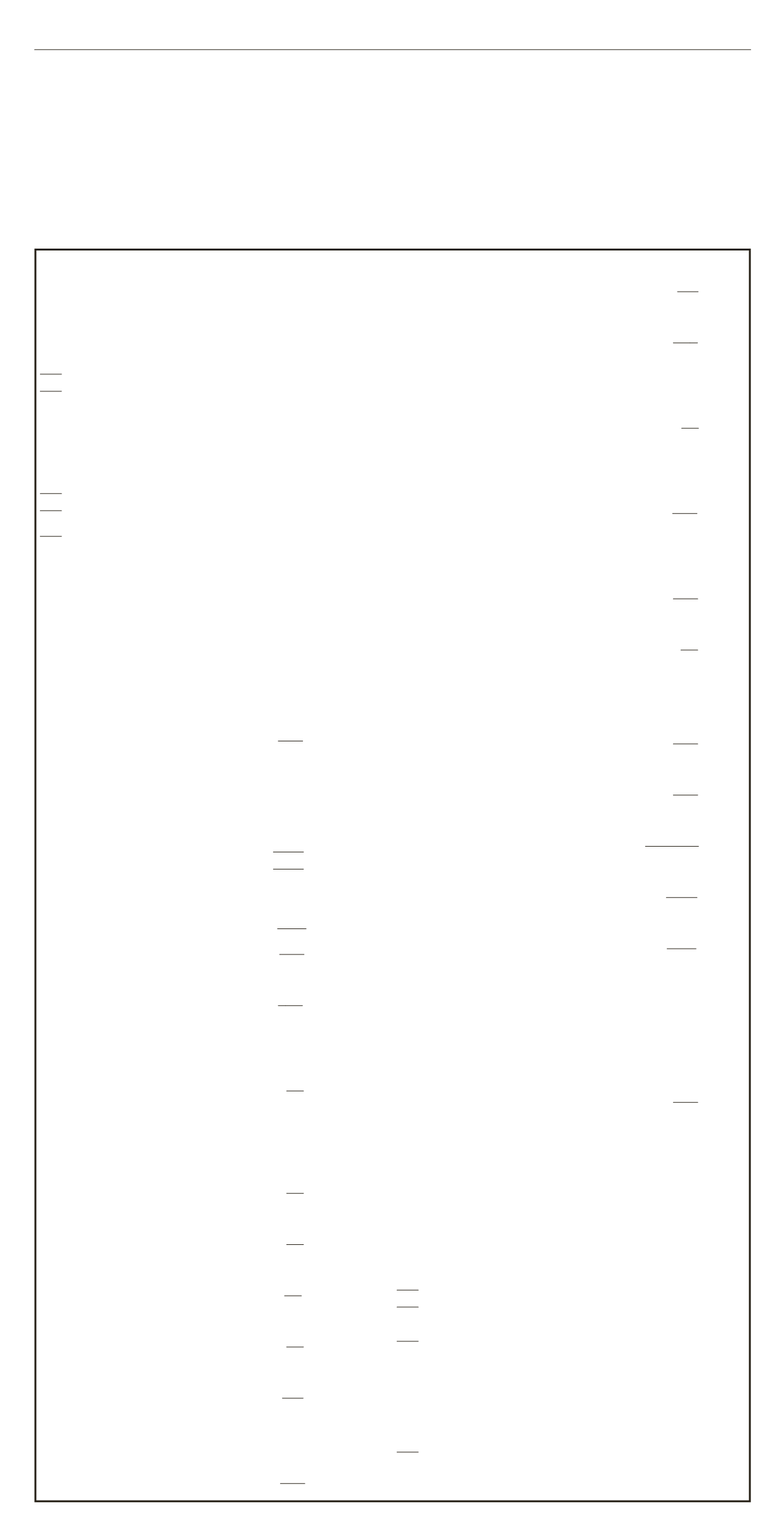

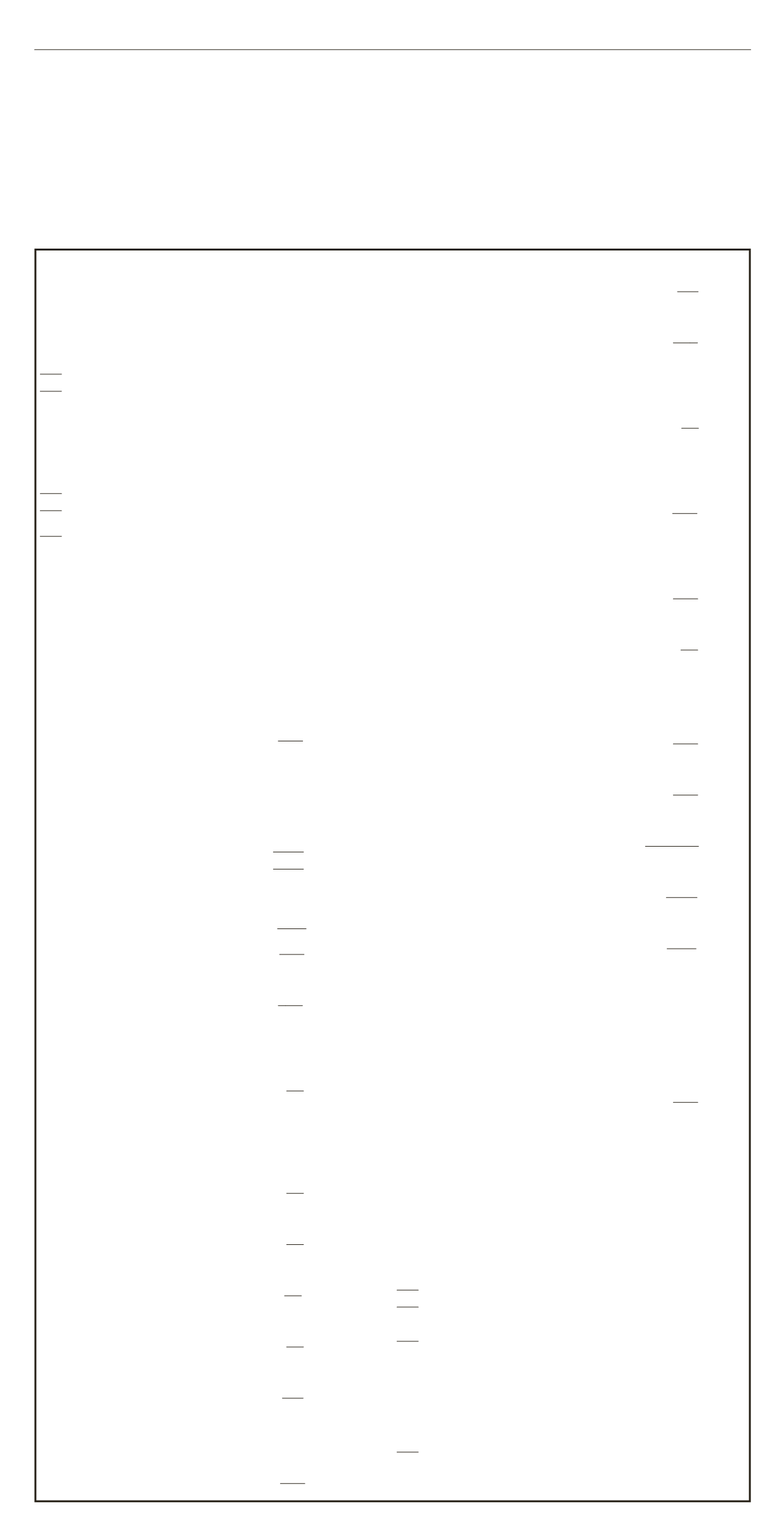

CITY OF ROMULUS

GENERAL AND SPECIAL APPROPRIATIONS ACT

A resolution to provide for the adoption of a budget proposed by the Mayor containing estimates of proposed rev-

enues and expenditures for the fiscal year beginning July 1, 2018 and ending June 30, 2019 and millage rates to

support this budget.

BE IT RESOLVED BY THE CITY COUNCIL OF THE CITY OF ROMULUS:

SECTION 1.

That for the expenditures of the City Government and its activities for the fiscal year, begin-

ning July 1, 2018 and ending June 30, 2019, the amounts in the following sections are hereby appropriated.

SECTION 2.

That for the said fiscal year there is hereby appropriated out of the General Fund on an activ-

ity basis, the following:

COUNCIL

88,870

MAYOR

701,970

CLERK

676,440

FINANCIAL SERVICES

2,249,990

TREASURER

458,420

PUBLIC SAFETY

13,966,035

PUBLIC SERVICES

3,189,120

COMMUNITY & ECONOMIC DEVELOPMENT

327,560

RECREATIONAL & CULTURAL

798,070

TOTAL EXPENDITURES

22,456,475

REVENUES

PROPERTY TAXES

7,614,090

BUSINESS LICENSES & PERMITS

214,200

FEDERAL GRANTS & REVENUES

66,110

STATE GRANTS & REVENUES

3,117,790

CHARGES FOR SERVICES

1,095,900

FINES & FORFEITS

1,700,000

INTEREST & RENTS

473,620

OTHER REVENUES

3,183,010

CONTRIBUTIONS FROM LOCAL UNITS

113,880

NON-BUSINESS LICENSES & PERMITS

1,340,000

TOTAL REVENUES

18,918,600

APPROPRIATION - FUND BALANCE

3,537,875

TOTAL REVENUES & APPROPRIATED FUND BALANCE 22,456,475

SECTION 3.

That for the said fiscal year there is hereby appropriated out of the Major Roads Fund on an

activity basis, the following:

MAJOR ROADS FUND EXPENDITURES

1,494,080

TRANSFER TO BEVERLY ROAD

-

TRANSFER TO LOCAL STREETS

700,000

TRANSFER TO DEBT FUND

203,630

TOTAL EXPENDITURES & CONTINGENCIES

2,397,710

REVENUES

1,907,100

APPROPRIATION - FUND BALANCE

490,610

TOTAL REVENUES & APPROPRIATED FUND BALANCE 2,397,710

SECTION 4.

That for the said fiscal year there is hereby appropriated out of the Local Streets Fund on an

activity basis, the following:

LOCAL STREETS FUND EXPENDITURES

1,871,660

REVENUES

1,360,600

APPROPRIATION - FUND BALANCE

511,060

TOTAL REVENUES & APPROPRIATED FUND BALANCE 1,871,660

SECTION 5.

That for the said fiscal year there is hereby appropriated out of the Romulus Athletic Center

Fund on an activity basis, the following:

ROMULUS ATHLETIC CENTER

2,155,170

REVENUES

2,161,350

SECTION 6.

That for the said fiscal year there is hereby appropriated out of the Cemetery Perpetuation

Fund on an activity basis, the following:

CEMETERY FUND

9,160

REVENUES

3,010

APPROPRIATION - FUND BALANCE

6,150

TOTAL REVENUES & APPROPRIATED FUND BALANCE

9,160

SECTION 7.

That for the said fiscal year there is hereby appropriated out of the Cable Television Fund on

an activity basis, the following:

CABLE TELEVISION

345,690

REVENUES

381,200

SECTION 8.

That for the said fiscal year there is hereby appropriated out of the Merriman Road Special

Assessment Fund on an activity basis, the following:

MERRIMAN RD SPECIAL ASSESSMENT

99,830

REVENUES

95,950

APPROPRIATION - FUND BALANCE

3,880

TOTAL REVENUES & APPROPRIATED FUND BALANCE 99,830

SECTION 9.

That for the said fiscal year there is hereby appropriated out of the Street Lighting Fund on an

activity basis, the following:

STREET LIGHTING

573,180

REVENUES

568,500

APPROPRIATION - FUND BALANCE

4,680

TOTAL REVENUES & APPROPRIATED FUND BALANCE 573,180

SECTION 10.

That for the said fiscal year there is hereby appropriated out of the Oakwood Special

Assessment District on an activity basis, the following:

OAKWOOD SPECIAL ASSESSMENT DISTRICT

24,800

REVENUES

20,830

APPROPRIATION - FUND BALANCE

3,970

TOTAL REVENUES & APPROPRIATED FUND BALANCE 24,800

SECTION 11.

That for the said fiscal year there is hereby appropriated out of the Community/Employee

Activity Fund on an activity basis, the following:

COMMUNITY/EMPLOYEE ACTIVITY FUND

3,260

REVENUES

-

APPROPRIATION - FUND BALANCE

3,260

TOTAL REVENUES & APPROPRIATED FUND BALANCE

3,260

SECTION 12.

That for the said fiscal year there is hereby appropriated out of the Sanitation Fund on an

activity basis, the following:

SANITATION

1,186,350

REVENUES

1,167,700

APPROPRIATION - FUND BALANCE

18,650

TOTAL REVENUES & APPROPRIATED FUND BALANCE 1,186,350

SECTION 13.

That for the said fiscal year there is hereby appropriated out of the Community Development

Block Grants Fund on an activity basis, the following:

COMMUNITY DEVELOPMENT BLOCK GRANTS

263,540

REVENUES

263,540

SECTION 14.

That for the said fiscal year there is hereby appropriated out of the 9 1 1 Fund on an activity

basis, the following:

9 1 1 FUND

278,500

REVENUES

155,000

APPROPRIATION - FUND BALANCE

123,500

TOTAL REVENUES & APPROPRIATED FUND BALANCE 278,500

SECTION 15.

That for the said fiscal year there is hereby appropriated out of the Federal Law Enforcement

Fund on an activity basis, the following:

FEDERAL LAW ENFORCEMENT

42,160

REVENUES

1,800

APPROPRIATION - FUND BALANCE

40,360

TOTAL REVENUES & APPROPRIATED FUND BALANCE

42,160

SECTION 16.

That for the said fiscal year there is hereby appropriated out of the State Law Enforcement

Fund on an activity basis, the following:

STATE FORFEITURE

193,200

REVENUES

51,090

APPROPRIATION - FUND BALANCE

142,110

TOTAL REVENUES & APPROPRIATED FUND BALANCE

193,200

SECTION 17.

That for the said fiscal year there is hereby appropriated out of the Municipal Library Fund

on an activity basis, the following:

MUNICIPAL LIBRARY

668,780

REVENUES

714,350

SECTION 18.

That for the said fiscal year there is hereby appropriated out of the Special Assessment -

Beverly Road Fund on an activity basis, the following:

SPECIAL ASSESSMENT - BEVERLY ROAD

94,780

REVENUES

88,920

APPROPRIATION - FUND BALANCE

5,860

TOTAL REVENUES & APPROPRIATED FUND BALANCE

94,780

SECTION 19.

That for the said fiscal year there is hereby appropriated out of the 2017B Court Building Debt

Service Fund on an activity basis, the following:

2017B COURT BUILDING CAPITAL IMPROVEMENT BONDS

1,042,380

REVENUES

1,405,000

SECTION 20.

That for the said fiscal year there is hereby appropriated out of the 2017A Ecorse/Vining

Capital Improvement Debt Service Fund on an activity basis, the following:

2017A ECORSE/VINING CAPITAL IMPROVEMENT BONDS

444,975

REVENUES

300

APPROPRIATION - FUND BALANCE

444,675

TOTAL REVENUES & APPROPRIATED FUND BALANCE

444,975

SECTION 21.

That for the said fiscal year there is hereby appropriated out of the 2014 Capital Improvement

Debt Service Fund on an activity basis, the following:

2014 CAPITAL IMPROVEMENT BONDS

203,630

REVENUES

203,630

SECTION 22.

That for the said fiscal year there is hereby appropriated out of the Sewer Debt Service Fund

on an activity basis, the following:

SEWER DEBT SERVICE

300,000

REVENUES

85,000

APPROPRIATION - FUND BALANCE

215,000

TOTAL REVENUES & APPROPRIATED FUND BALANCE

300,000

SECTION 23.

That for the said fiscal year there is hereby appropriated out of the Water Debt Service Fund

on an activity basis, the following:

WATER DEBT SERVICE

30,000

REVENUES

20,500

APPROPRIATION - FUND BALANCE

9,500

TOTAL REVENUES & APPROPRIATED FUND BALANCE

30,000

SECTION 24.

That for the said fiscal year there is hereby appropriated out of the Court Building

Construction Fund on an activity basis, the following:

COURT BUILDING CONSTRUCTION

-

REVENUES

6,000

SECTION 25.

That for the said fiscal year there is hereby appropriated out of the Ecorse Construction &

Vining Road Extension Fund on an activity basis, the following:

ECORSE CONSTRUCTION & VINING ROAD EXTENSION

130,730

REVENUES

1,100

APPROPRIATION - FUND BALANCE

129,630

TOTAL REVENUES & APPROPRIATED FUND BALANCE

130,730

SECTION 26.

That for the said fiscal year there is hereby appropriated out of the Tax Increment Finance

Authority Vining Road Construction Fund on an activity basis, the following:

TIFA-VINING CONSTRUCTION

160,040

REVENUES

1,000

APPROPRIATION - FUND BALANCE

159,040

TOTAL REVENUES & APPROPRIATED FUND BALANCE

160,040

SECTION 27.

That for the said fiscal year there is hereby appropriated out of the Sewer and Water Fund on

an activity basis, the following:

SEWER AND WATER

18,968,040

REVENUES

17,591,800

APPROPRIATION - FUND BALANCE

1,376,240

TOTAL REVENUES & APPROPRIATED FUND BALANCE

18,968,040

SECTION 28.

That for the said fiscal year there is hereby appropriated out of the Vehicle and Equipment

Fund on an activity basis, the following:

MOTOR VEHICLE AND EQUIPMENT

1,761,550

REVENUES

1,285,790

APPROPRIATION - FUND BALANCE

475,760

TOTAL REVENUES & APPROPRIATED FUND BALANCE

1,761,550

SECTION 29.

That for the said fiscal year there is hereby appropriated out of the Technology Services Fund

on an activity basis, the following:

TECHNOLOGY SERVICES

784,255

REVENUES

746,070

APPROPRIATION - FUND BALANCE

38,185

TOTAL REVENUES & APPROPRIATED FUND BALANCE

784,255

SECTION 30.

That for the said fiscal year there is hereby appropriated out of the Retirement Insurance

Benefit Fund on an activity basis, the following:

RETIREE INSURANCE BENEFITS

2,609,200

REVENUES

2,771,490

SECTION 31.

That for the said fiscal year there is hereby appropriated out of the Property and Liability Self-

Insurance Fund on an activity basis, the following:

PROPERTY AND LIABILITY SELF INSURANCE

585,460

REVENUES

664,720

SECTION 32.

That for the said fiscal year there is hereby appropriated out of the Brownfield Redevelopment

Authority Fund on an activity basis, the following:

BROWNFIELD REDEVELOPMENT AUTHORITY

2,740

REVENUES

12,050

SECTION 33.

That for the said fiscal year there is hereby appropriated out of the Downtown Development

Authority Fund on an activity basis, the following:

DOWNTOWN DEVELOPMENT AUTHORITY -

523,390

REVENUES

420,700

APPROPRIATION - FUND BALANCE

102,690

TOTAL REVENUES & APPROPRIATED FUND BALANCE

523,390

SECTION 34.

That for the said fiscal year there is hereby appropriated out of the Tax Increment Finance

Authority Funds on an activity basis, the following:

TIFA DISTRICT II -

3,457,400

REVENUES

4,581,035

SECTION 35.

That for the said fiscal year there is hereby appropriated the following Capital Budget expen-

ditures:

CAPITAL BUDGET

4,211,260

SECTION 36.

That amounts budgeted for specific items or purposes and not required to be utilized for such

items or purposes may be spent by the Mayor for other items or purposes within the same activity for which such

allocations are made.

SECTION 37.

Be it further resolved that the following millage rates as provided by charter or statute be

assessed:

OPERATING MILLAGE

9.4063

P.A. 359 MILLAGE

0.0542

LIBRARY MILLAGE

0.7000

SANITATION MILLAGE

1.5500

EPA LEVY MILLAGE

1.2222

SECTION 38.

Be it further resolved that the Property Tax Administration Fee and any type of late penalty

charge as provided for by charter or statute be assessed.

Motion Carried Unanimously

.

6A. Clerk’s Report:

18-172 6

A

1

. Moved by

Roscoe

, seconded by

Talley

to reschedule the Public Hearing for Demolition List 18-01

from June 4, 2018 to Monday, June 25, 2018 at 6:30 p.m.

Motion Carried Unanimously

.

18-173 6

A

2

. Moved by

Wadsworth

, seconded by

Talley

to schedule a study session on Tuesday, May 29, 2018 at

6:45 p.m. to discuss an addendum to Romulus Ordinance Section 36-357 – titled “Notification of Carrying a

Concealed Weapon” and to discuss Courts and Law Enforcement Management Information Systems (CLEMIS).

Motion Carried Unanimously

.

18-174 6

A

3

. Moved by

Roscoe

, seconded by

Talley

to adopt the 2018-2019 City of Romulus Proposed Fee

Schedule.

Roll Call Vote: Ayes

– Barden, Roscoe, Talley, Wadsworth, Webb.

Nays

– Williams.

Motion Carried

.

6B. Treasurer’s Report:

City Treasurer, Stacy Paige, thanked City Council for the opportunity to attend the annual treasurer’s conference.

7. Public Comment:

Three City employees/labor union representatives thanked City Council for voting to opt out of Public Act 152 for

fiscal year 2018/2019.

8. Unfinished Business: None.

9. New Business:

Councilwoman Williams asked Finance Director, Suzanne Moreno, to set up a meeting with her to discuss the City

budget.

10. Communication:

Councilwoman Roscoe congratulated the new Romulus Citizens Academy graduates.

18-175 11

. Moved by

Talley,

seconded by

Roscoe

to pay Warrant 18-09 in the amount of $1,232,582.36.

Motion

Carried Unanimously

.

12.

Moved by

Wadsworth,

seconded by

Roscoe

to adjourn the regular meeting of the Romulus City Council.

Motion Carried Unanimously

.

I, Ellen L. Craig-Bragg, Clerk for the City of Romulus, Michigan do hereby certify the foregoing to be a true copy

of the minutes of the regular meeting of the Romulus City Council held on May 14, 2018.

RM0302 - 052418 5 x 18.363

A 17-year-old Canton student

has been arrested in connection

with a bomb threat at the

Plymouth-Canton Educational

Park last Thursday.

According to police reports,

the threat was made through

social media and when school

officials were made aware of the

post by a student, they immedi-

ately notified the school resource

officers and the Canton Police

Department.

Public safety officials and

school administrators assessed

the situation, according to police

reports, and began an investiga-

tion into the threat. That investi-

gation led to the arrest of one stu-

dent, believed to have acted

alone.

Although police officials deter-

mined there was no threat to the

safety of staff and students at the

educational park, therewill be an

increased police presence on

campus along with the school

resource officers, police said.

“We applaud the very respon-

sible individual who quickly

reported this post to school

administration, and we continue

to be proud of our community's

dedication to keeping our schools

safe,” said Monica L. Merritt,

superintendent of Plymouth-

Canton schools. “Student and

staff safety will remain the num-

ber one priority of Plymouth-

Canton Community Schools,” she

concluded.

School district administrators

will continue to work with police

as they finalize their investigation

before submitting their findings

to the Wayne County Prosecutor's

Office for reviewof possible crim-

inal charges.

“The

Canton

Police

Department is dedicated to thor-

oughly investigating all threats to

the safety of our residents, and

specifically our student popula-

tion,” said Deputy Director of

Police Chad Baugh. Plymouth

Canton Community Schools and

the Canton Police Department

are grateful for the actions of the

individual who notified authori-

ties of the threat.”

Canton teen arrested in school bomb threat